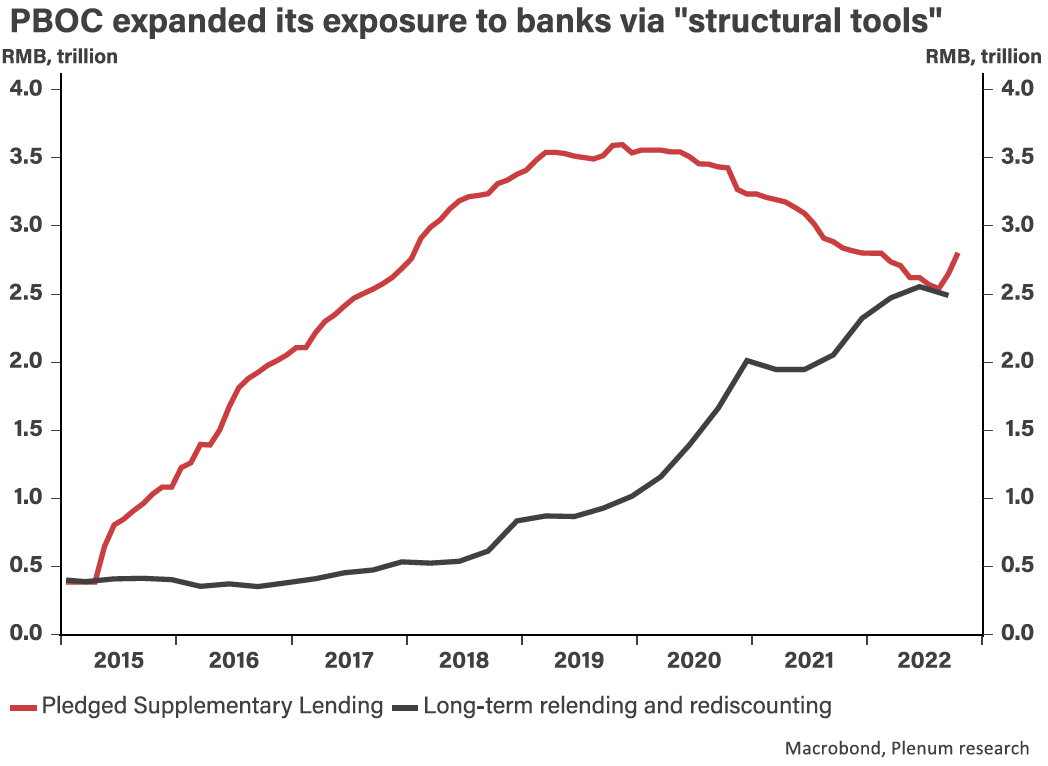

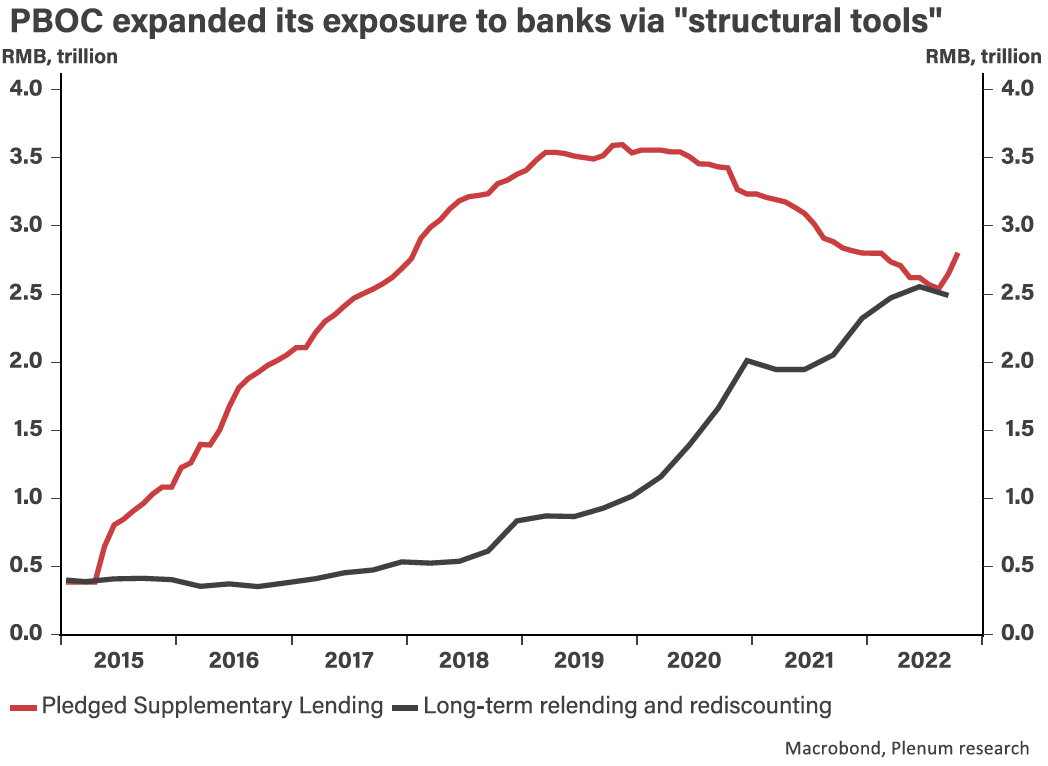

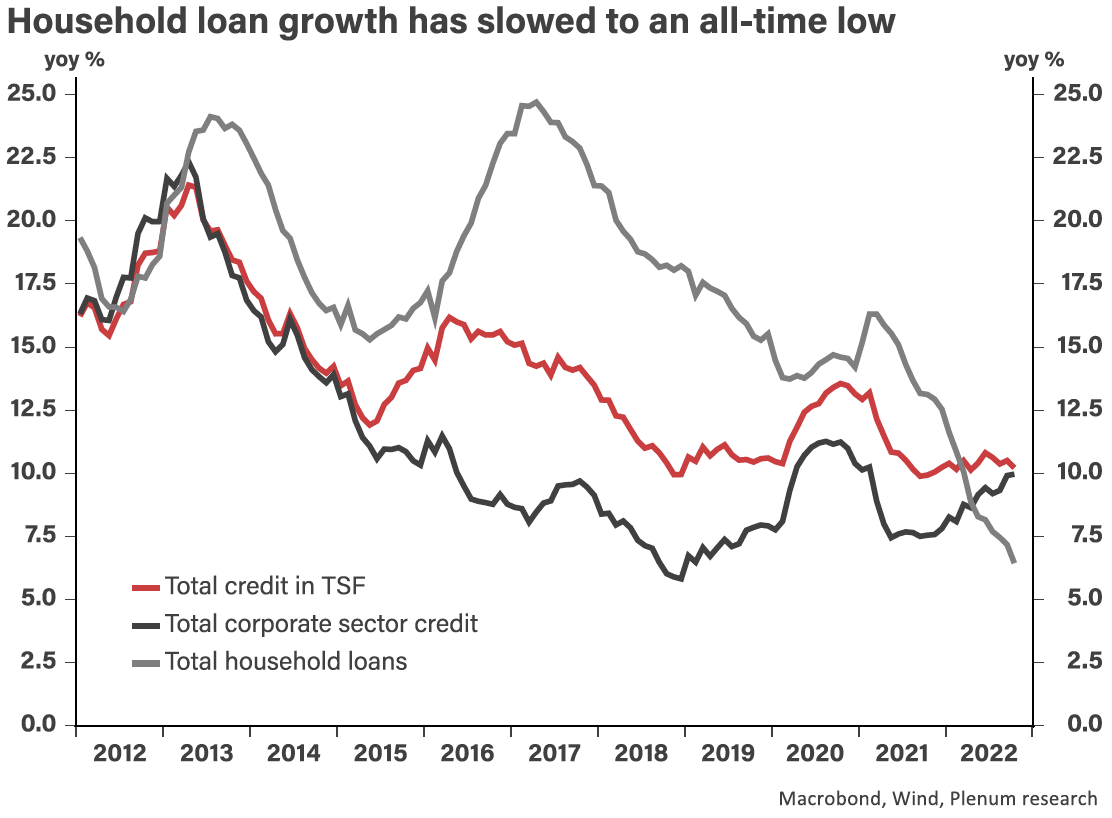

The PBOC has resorted to using structural monetary policy tools to more directly encourage banks to lend, but the impact will not be felt for some time.

The PBOC has resorted to using structural monetary policy tools to more directly encourage banks to lend, but the impact will not be felt for some time.

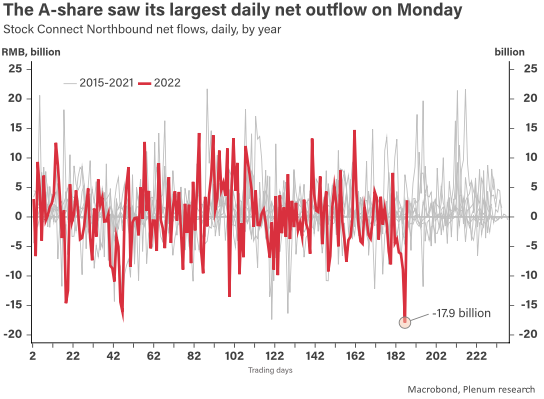

The October economic data is awful, but the market is looking forward rather than back, and this could be the beginning of the end for zero-Covid.

With the Party and state in transition, Beijing’s new policy direction may not come into focus until March 2023 when the new premier is installed.

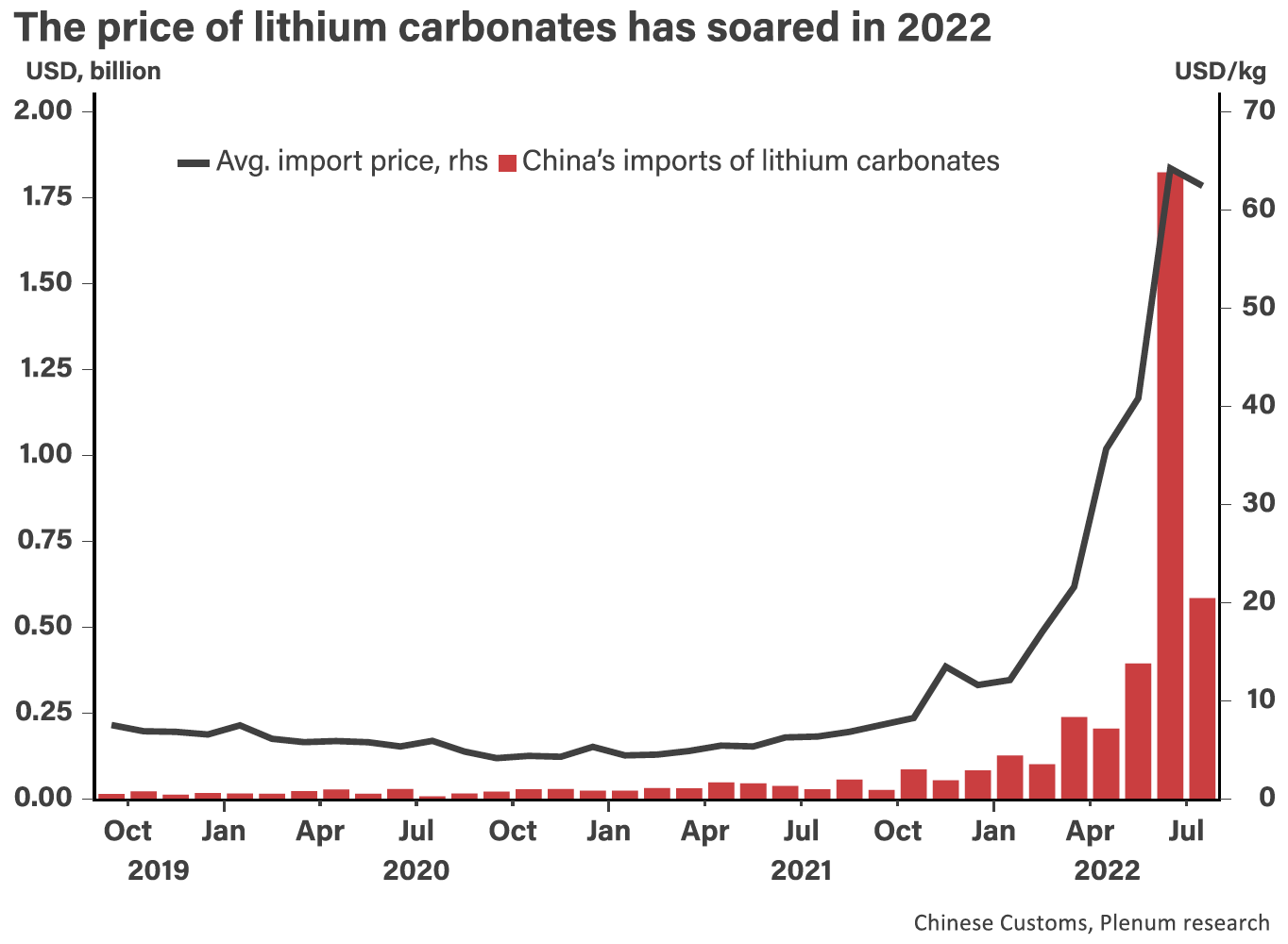

Chinese companies have invested in multiple lithium projects in South America and Africa to hedge against dependency on Australia.

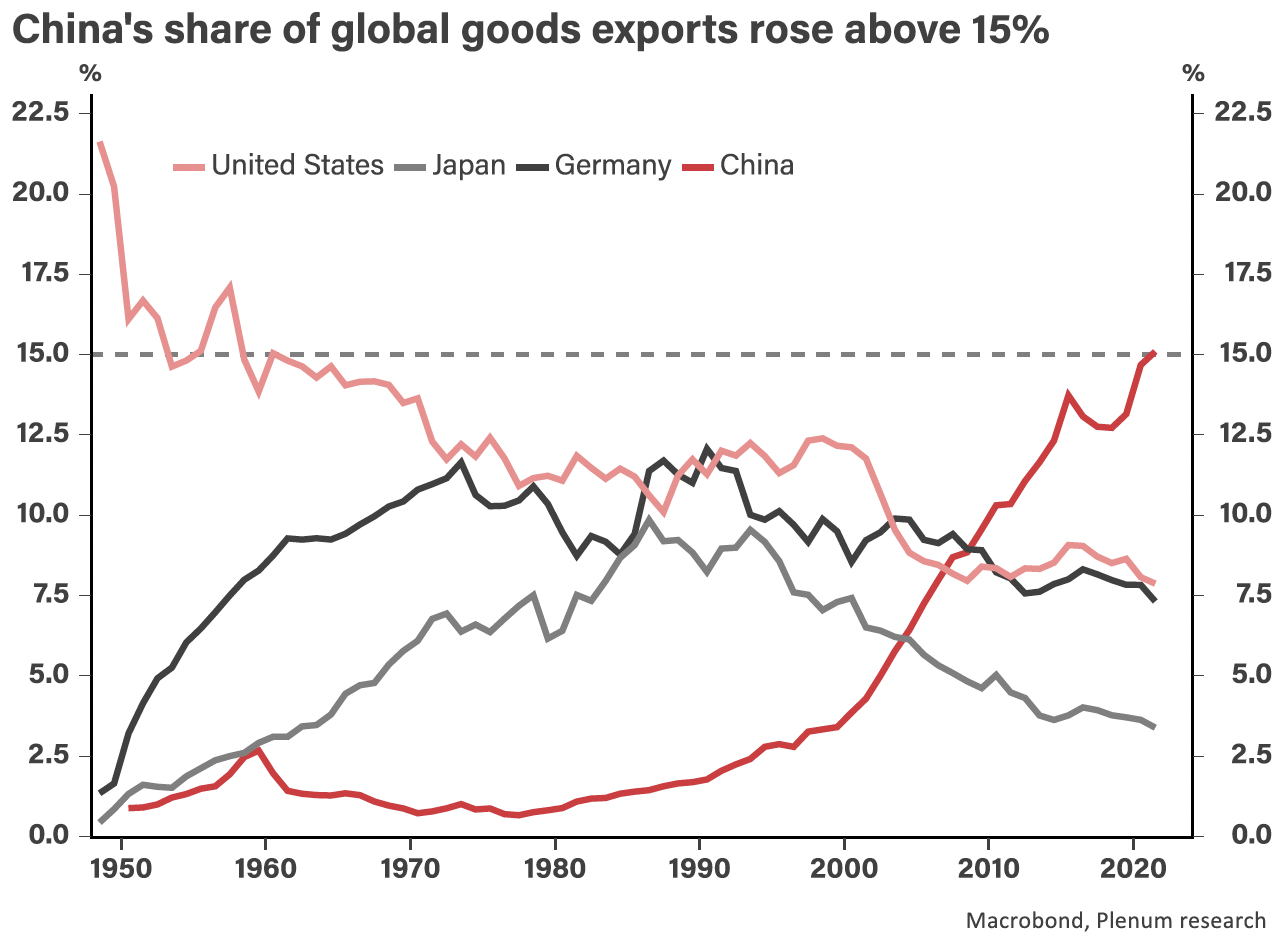

If China will feel the impact of the global energy crisis, it will likely be in its exports.

China’s growth looked better in August, mainly due to the low base, but slowing exports are a concern and real estate has not recovered despite more easing.

China’s trade surplus has exploded while other “export-oriented” nations saw shrinking surpluses, or deficits, which could be problematic for trade relations.

The two sides appear to have different understandings of how the papers will be accessed, as well as the role of Chinese regulators in the inspection process.