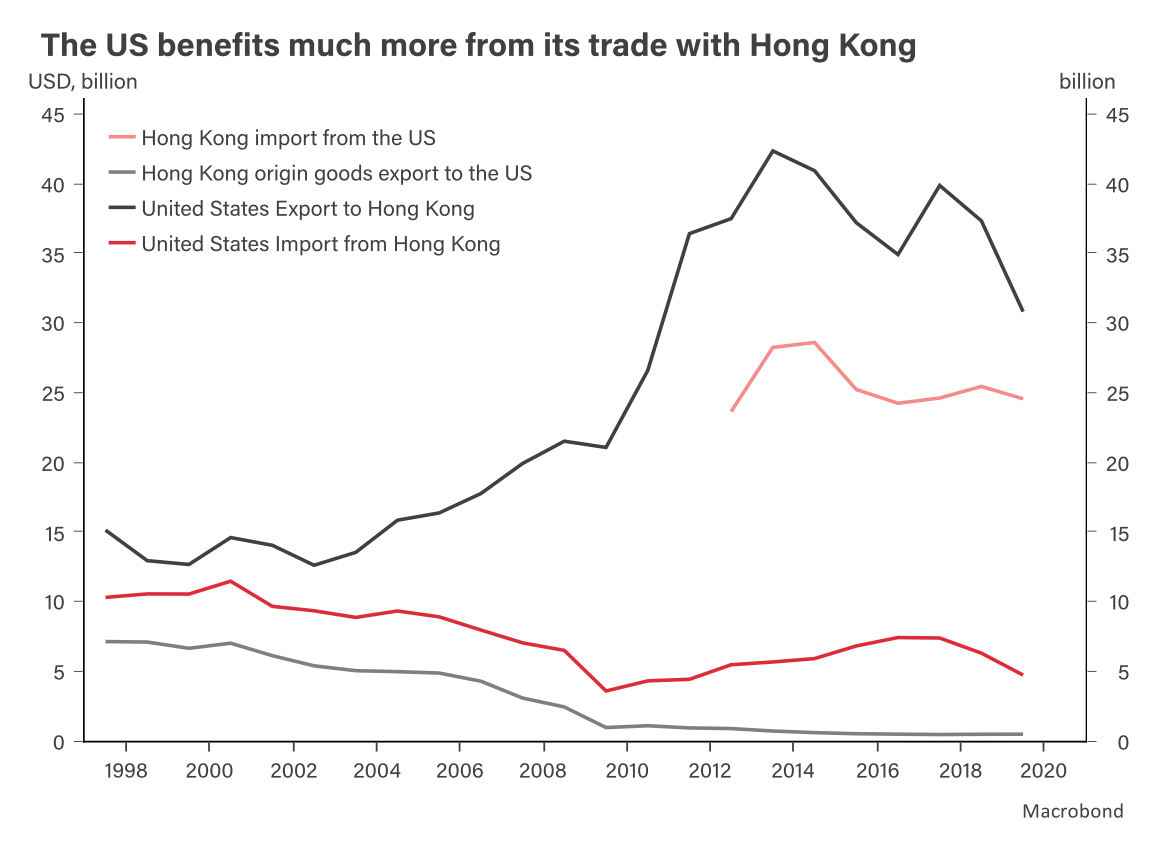

It is unlikely for Washington to end its other “special treatments” for Hong Kong because it hurts the Americans even more.

The latest move is consistent with Beijing’s hardline stance in response to the political turmoil on the island since 2019.

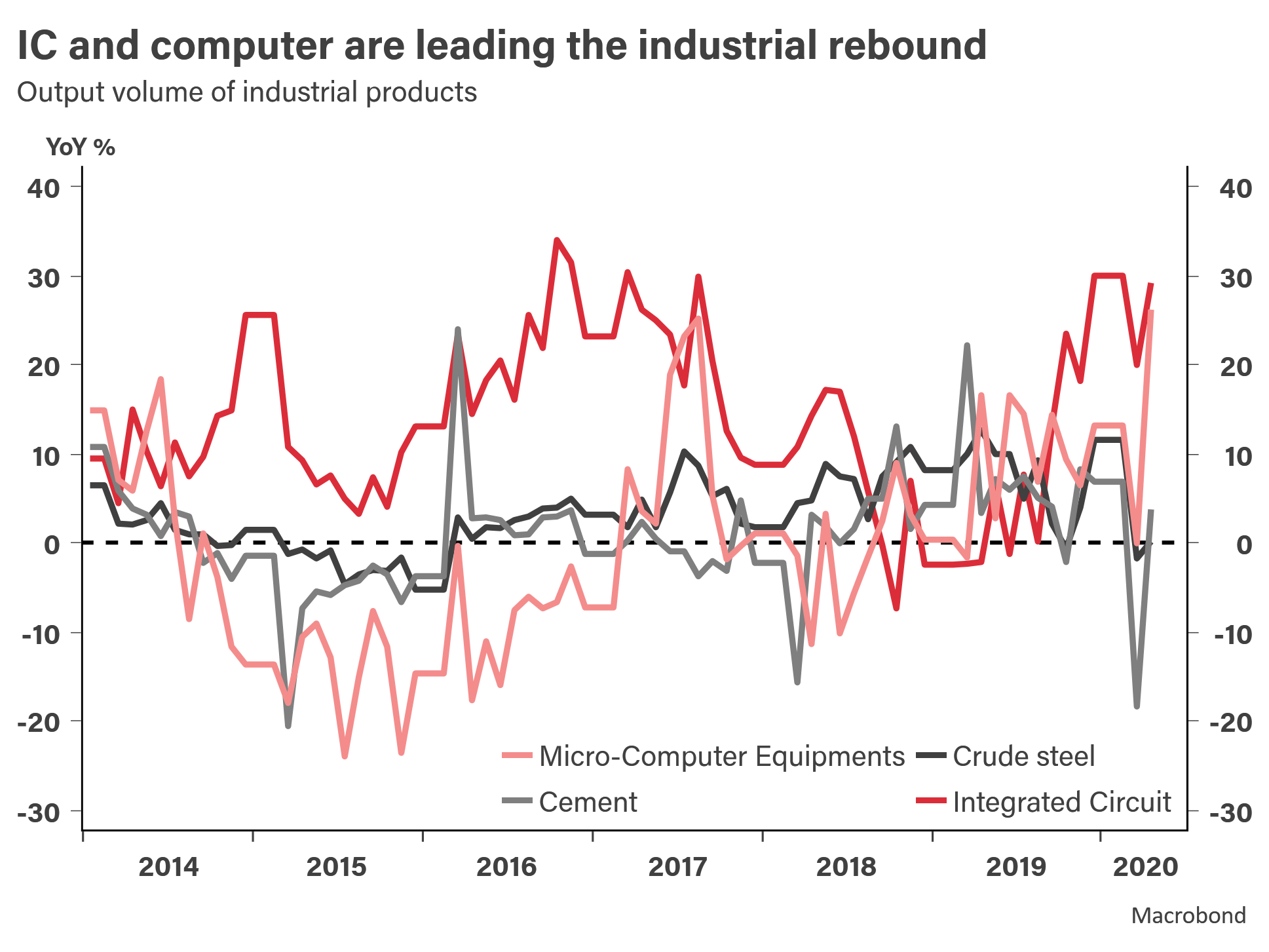

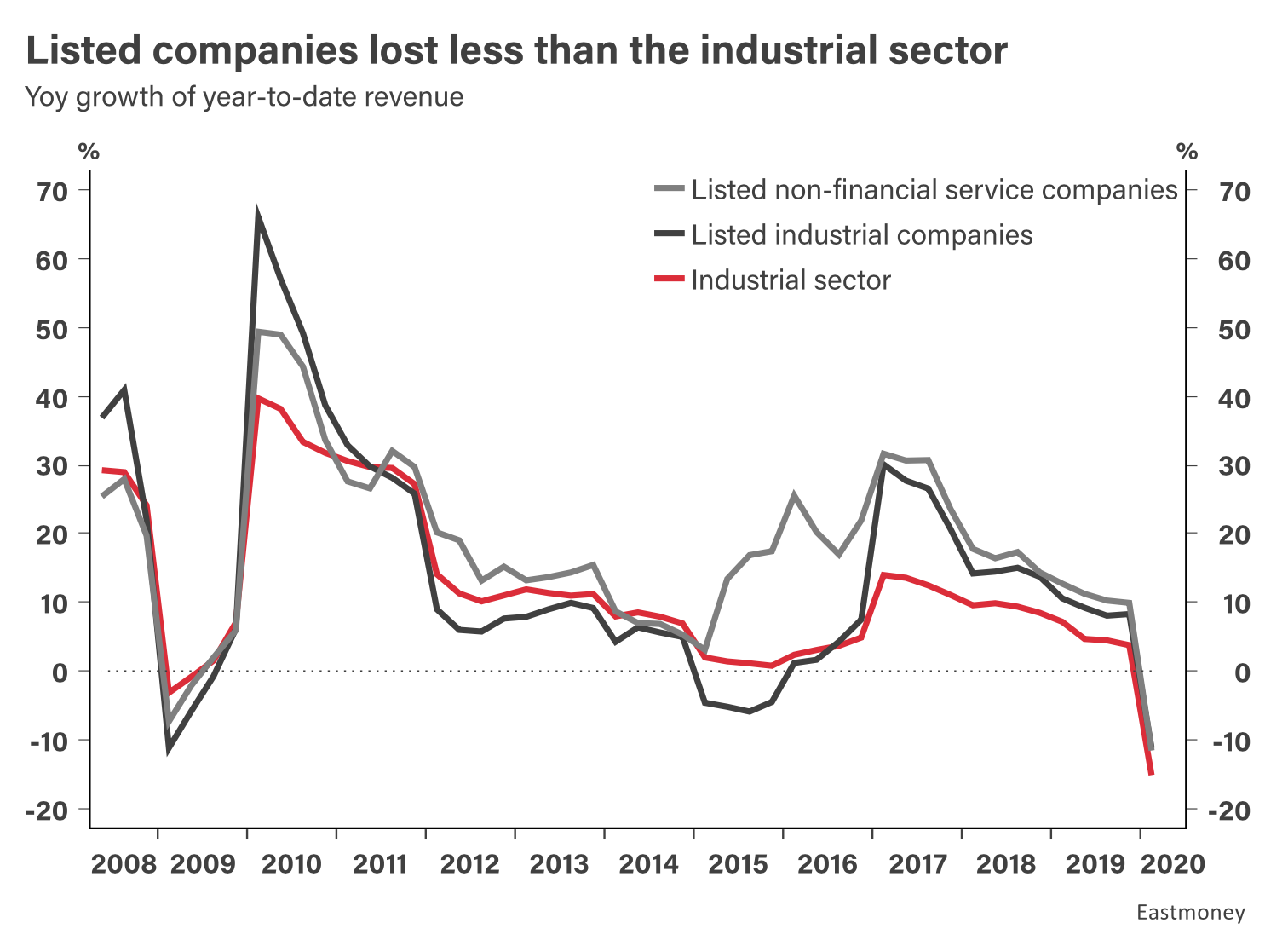

China’s A-share listed firms suffered significantly at the beginning of 2020 because of the COVID-19 pandemic.

The QR code system is likely to stay in place after COVID-19 as a new socio-economic norm.

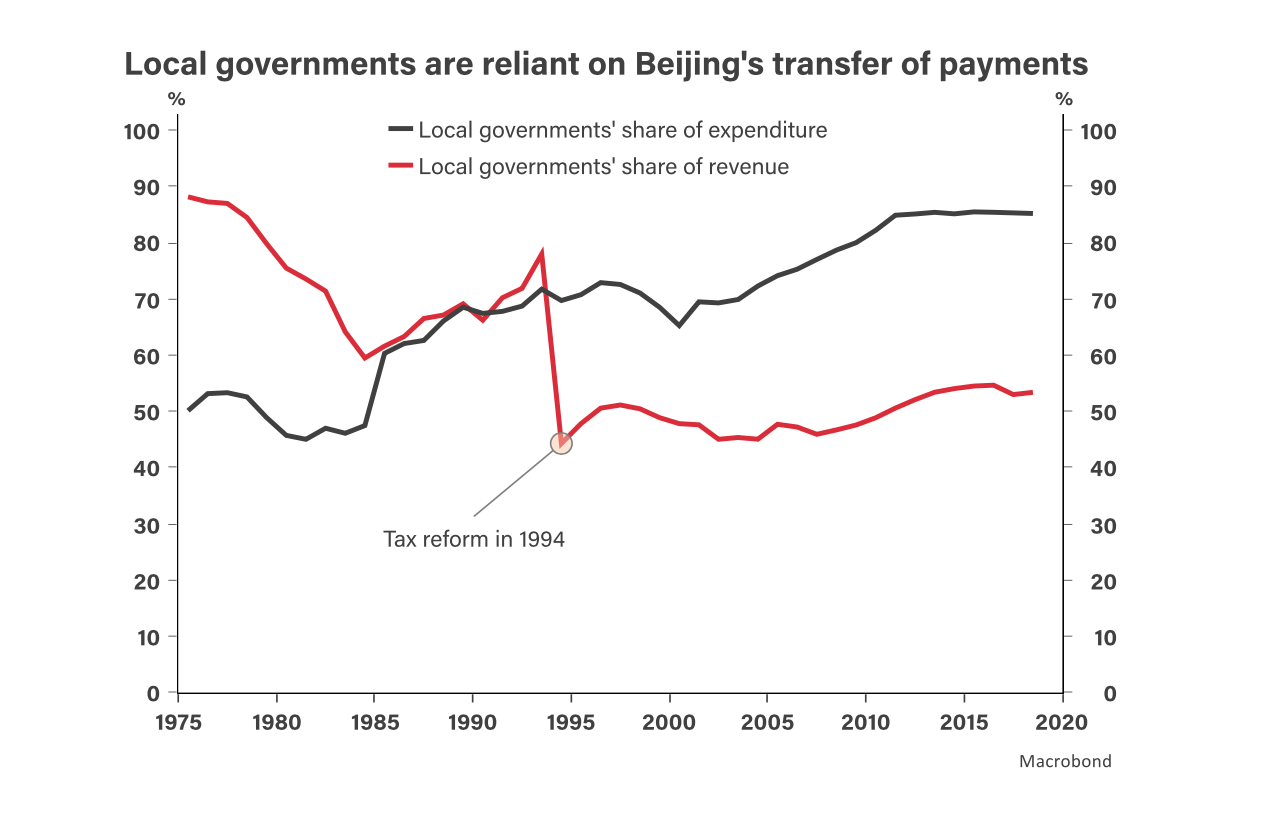

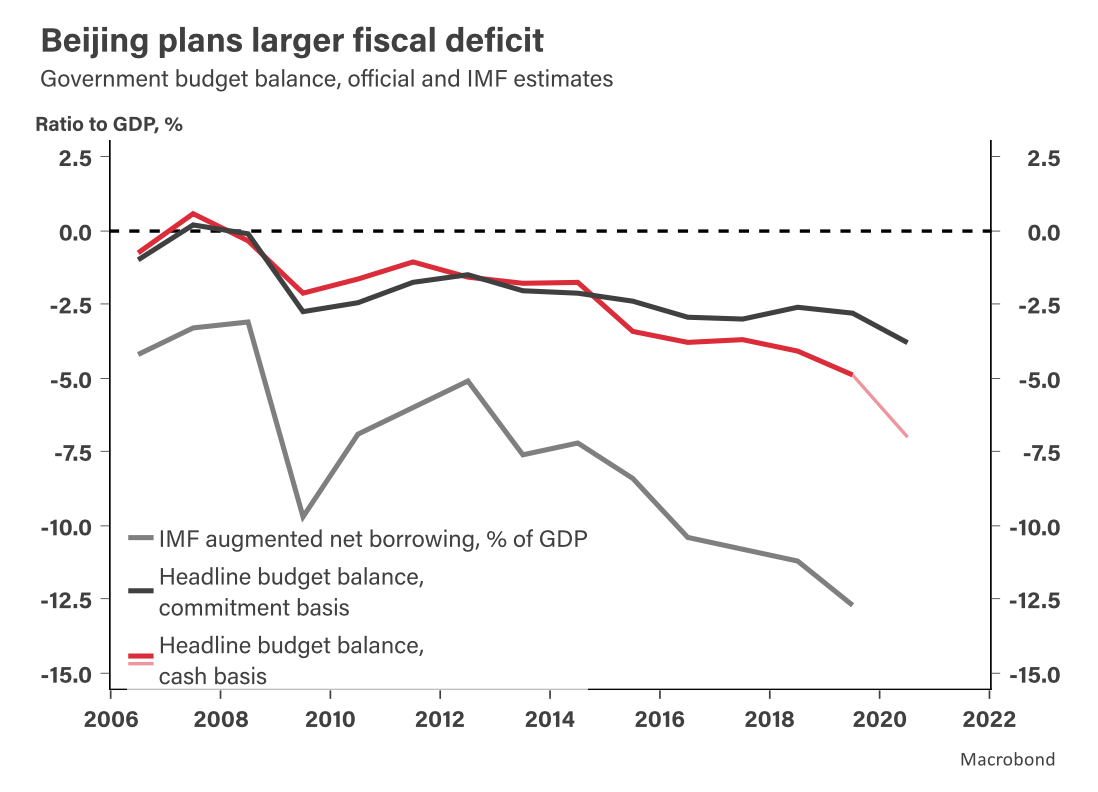

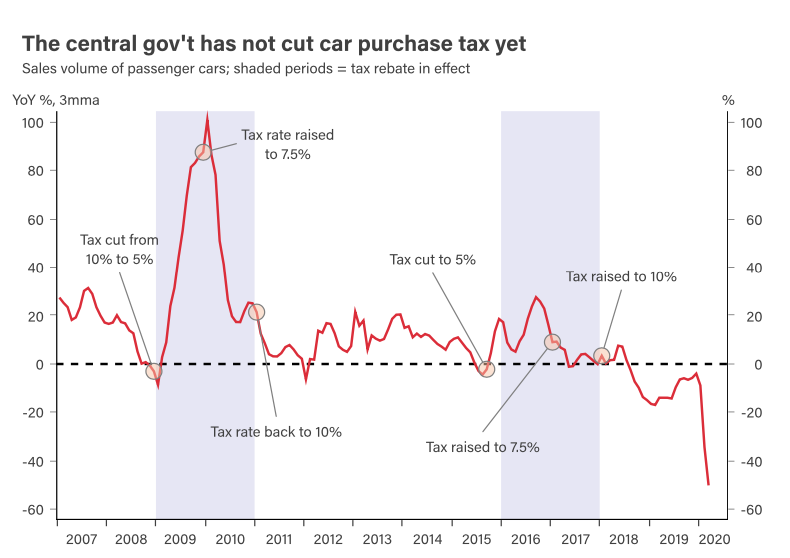

Local governments are ramping up subsidies on cars and housing while Beijing is not delivering a big-bang stimulus.