Six senior state-owned enterprise (SOE) managers have been promoted to provincial vice governorships

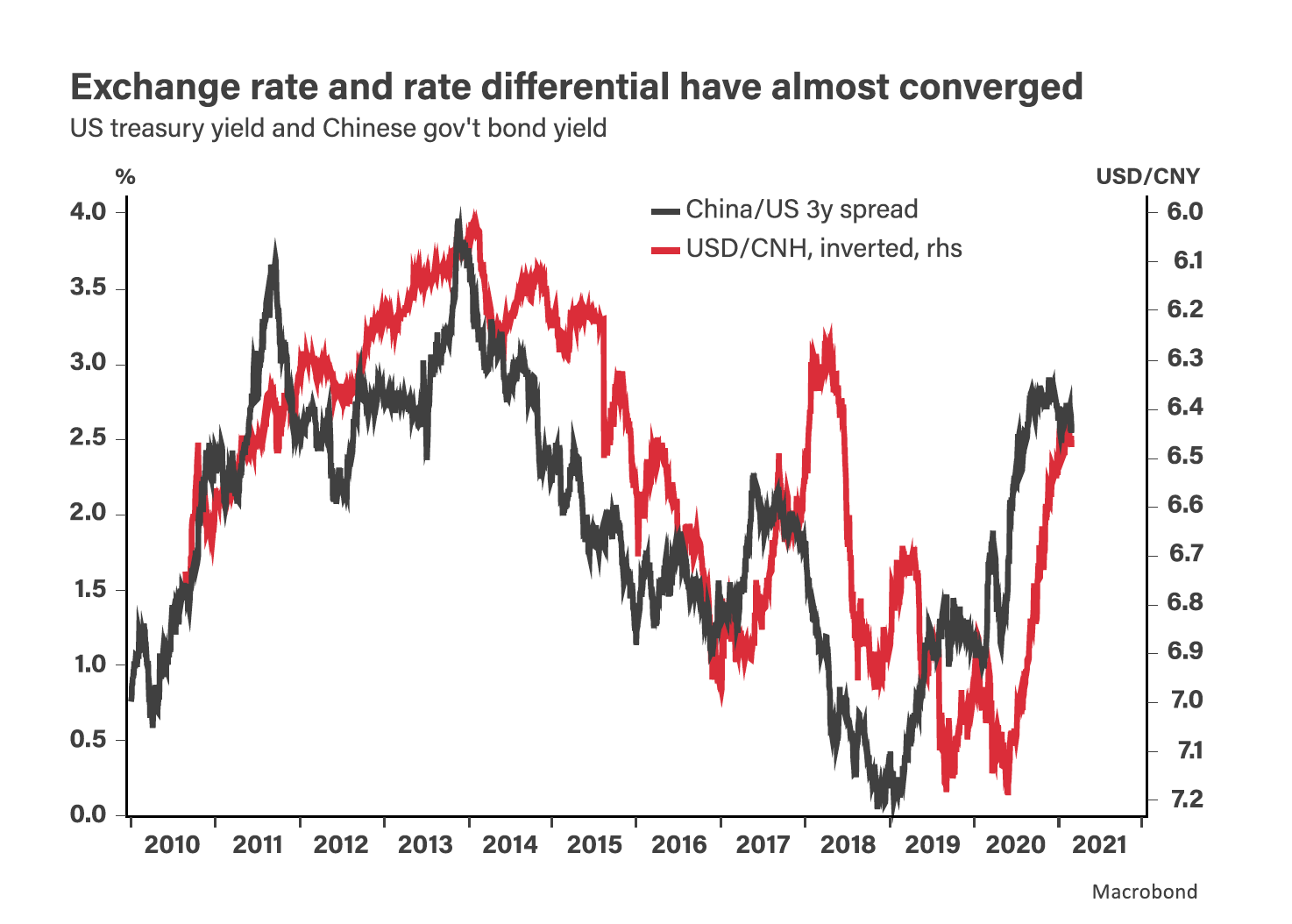

USD/CNH has started to catch up with the broad strength of the USD and will continue to accelerate.

The final version of the antitrust guidelines was significantly milder than its draft form